A healthy body is in balance when it has the right amount of inflammatory and anti-inflammatory signalling. Working out increases inflammation which makes you stronger. Your body ramps up its inflammatory response when it gets sick so that you can mount an offence against the invading germ. Sleep, healthy eating, stress relief, etc are all anti-inflammatory activities that bring the system back into balance. Runaway inflammation leads to auto-immune diseases, cancer and generally not good outcomes. It’s all about the balance.

A little poison can be good for you. Caffeine for example is slightly toxic, but creates a hormetic response in the body, which in turn leads to a healthier state, because the body reacts to the poison by ramping up it’s defences. An economy is natural complicated system, much as your body. In a similar fashion, the economy can tolerate some poison and thrive. But what happens when you keep poisoning the economy for decades? You end up with runaway inflation, which has the same exact outcome as runaway inflammation in the body. You rot from the inside.

WTF happened in 1971?

Something weird happened in the U.S. in 1971. All kinds of social and fiscal progress suddenly switched gears and started heading in the wrong direction.

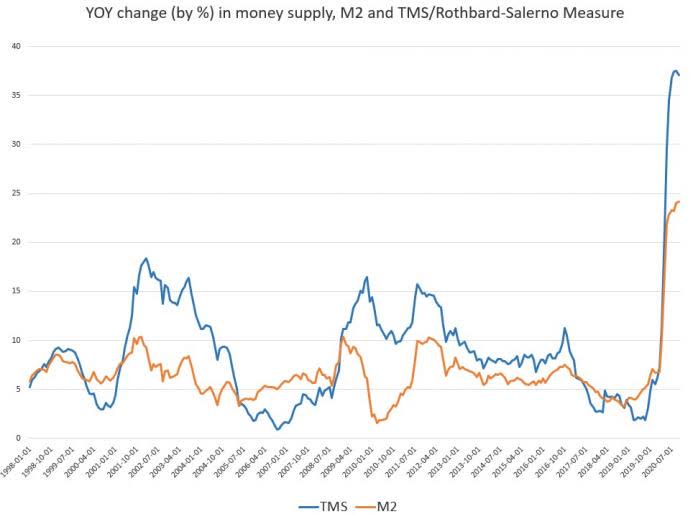

The U.S. went off the gold-standard in 1971 which in practice means that the dollar was backed by gold prior and backed by nothing after. The U.S. dollar became just paper and what’s known as a “fiat currency.” The cumulative effects of this one simple change are remarkable. When you give someone free rein to print more money without doing the work (mining / buying more gold), that’s going to be very hard to resist. Especially if you’re a politician and only concerned about short-term outcomes. So the U.S. started to expand the money supply. First slowly, then a little bit more and in 2020 by an insane amount.

Since U.S. dollar is basically the world reserve currency, the entire western world is along on this ride. The Euro and USD for example are so closely interlinked that if one currency collapses, the other one goes with it. And the European Central Bank has been closely following in the footsteps of the its American counterparts when it comes to runaway money printing.

What’s the big deal with inflation though?

Inflation is such a positive-sounding word isn’ it. Inflation. The economy inflates. That’s a good thing, right? The opposite would be deflation, which sounds bad. We don’t want our economies to deflate. But it’s all just word trickery. Inflation is actually just a silent tax on everyone, all the time. If the economy runs at a very conservative 3% inflation, meaning the money supply is expanded by 3% every year, meaning you lose 3% of your purchasing power per year, meaning prices go up by 3% every year, you will lose half of your savings after 20 years. If the inflation is 10%, you basically lose it all.

Well you don’t want to lose half your money in 20 years time so what do you do? You got two options: You spend it or you invest it. Many people will choose the first option and you end up with the economy that we have today, built mainly on consumption. If the money is going to be worth less tomorrow than it is today, might as well spend it. So you buy crap. Shitloads of crap. 8 euro avocado toast? Sounds good. 7 euro cup of coffee. Sign me up. 300 euro plastic piece of crap chair? I need one.

The people who got some extra money left, will want to invest. But they’re not professional investors so they don’t understand the markets. They’ll trust their money to people who do this for a living. The bankers.

Suddenly you have this whole class of people who only have one job: Try to beat the inflation by speculating on the markets. Do whatever it takes to grow the investment more than inflation and you’re all set. So people start bending the rules. They’ll start to come up with new ways to bet on the markets, creating new more complicated assets and derivatives, mathematical models and high-speed trading algorithms all just to get away from the simple fact that money is losing value year by year. Just think how much brain power is wasted on a yearly basis by focusing on this stuff instead of building something of real underlying value.

So inflation by its mere act of existing does two things: It creates a wasteful consumption-driven economy and mindset, and it wastes the talents of some of our smartest people on gaming the system instead of generating real wealth.

WTF happened in 2020?

If 1971 was the year that the world economy started to poison itself, 2020 was the year when the cytokine superstorm hit. The U.S has printed trillions of dollars and more stimulus packages are on the way. But the only thing they’ll stimulate is the economic immune system. Inflammation through inflation has ravaged the economy for decades and we were already in dire straits. Now we got hit with something that will kill us.

It’s clear as day that hyperinflation is coming. It’s the logical outcome of the ever-expanding money supply. There’s just one catch: Since the U.S. dollar is the world reserve currency, the impact will be global. If the currencies and economies hyper-inflate everywhere all at once, does anyone really hyper-inflate? These are uncharted waters. Regardless, one thing holds true: Real assets have real value today, and will have real value tomorrow in a hyper-inflationary world. A house you live in has real value. Energy creation has real value. Food has real value. Shares in a company have real value. But how much of that current value of your house or stock portfolio will melt away if the economy grinds to a screeching halt? That’s hard to say.

The Great Reset is coming

I think the World Economic Forum and the merry folks at Davos know all this. That’s why they’re telling us that we need a great reset. They’ll blame it on Covid-19 but actually it was the always the logical outcome from the decades of poisoning our economies. Covid-19 was just the final nail on the coffin. The tricky thing of course is that they are right. We do need a reset. And it will come in one shape or another, a global economic meltdown being a likely suspect. But here’s the question: Do you really want the same people who orchestrated our current economic disaster be the ones in charge of designing a new system? These are troubling times and great skepticism is needed. When our politicians start to push for solutions that sound too good to be true, it’s because they are. There’s no such thing as free lunch, and we’ve been stuffing our faces with food at the buffet for 50 years. The invoice is now due.

The only thing that can sustain an economy through the coming storm is real wealth creation. That means real innovation, real hard science and real commercial breakthroughs. So when those politicians start talking about the coming problems and their proposed solutions, ask them how are they planning to generate more real wealth instead of more inflation.