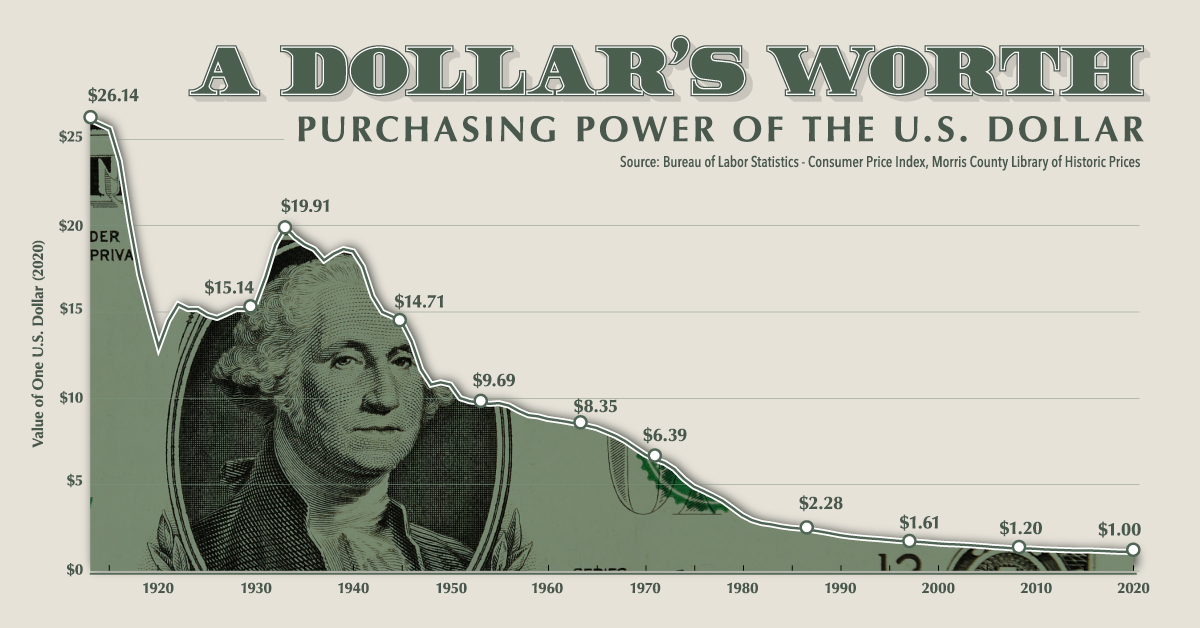

Bitcoin crashed 40%ish today and died for the 414th time. A small speed bump on the way to world domination and a true monetary revolution. The entire world will eventually use Bitcoin as the base layer of value for everything. There will be dollars, yuans, euros, etc but they will all be denominated in Bitcoin. In your everyday life you won’t think about Bitcoin that much. You’ll still buy your cup of coffee with dollars or euros, or actually with cryptodollars and cryptoeuros to be specific. But you’ll have a savings account in Bitcoin though. Otherwise you’d just be dumb. Why would you save with an inflationary currency when there’s a deflationary one available that will always go up in price compared other currencies? Sounds crazy I’m sure, but so did the internet in 1980.

Undisputed decentralized truth

There will only ever be 21 million Bitcoin, and the last one will be mined sometime around 2140. But one Bitcoin can be broken up into 100 million Satoshis. Pretty soon we won’t be talking about Bitcoins. We’ll be talking about Satoshis, named of course after Bitcoin inventor Satoshi Nakamoto, an unknown individual or group of people who disappeared mysteriously soon after it’s inception. This 21 million is the magic number that makes Bitcoin what it is. It’s the only thing in the entire universe with a guaranteed fixed supply. The only thing that is truly scarce. You can’t bribe anyone to create more Bitcoin. You can’t threaten anyone to create more Bitcoin. You can’t counterfeit Bitcoin. And once you transfer a Bitcoin, it’s gone forever. It’s immutable and immoveable.

Bitcoin isn’t really money. It’s a ledger of ownership. Bitcoin is digital property rights. It’s unfalsifiable truth. If you own the key to a wallet, you have access to the wallet. If you don’t, you don’t. Again, it’s the only asset in the universe that has these qualities. Every other thing of value you own needs to be validated or protected by a 3rd party for it to have value. The US government can decide to make your dollars obsolete. The bank you hold your gold in can decide to confiscate it. Your country can evict you from your lands. Holding Bitcoin makes you truly sovereign. You’re not financially dependant on anyone. This is a scary proposition for most people, but an absolute necessity for independent nation states.

But what about the network itself? Surely they can fuck you over and take your Bitcoin? No, they can’t. Bitcoin network is structured to promote decentralisation and security above everything else. It harvests human greed and turns it into individual sovereignty. Every individual actor inside the system is incentivised to promote systemic decentralisation, because it benefits them as individuals. The miners will happily confirm and secure your transactions because they get a reward. More people joining the network increases your individual buying power so you’ll have no incentive to keep them out. And on the virtuous cycle goes.

The geopolitical game theory

The undisputed nature of Bitcoin makes it the hardest form of money ever known to man. It’s also the only impartial form of money ever invented. The US, China, Elon Musk or your grandma can’t change it. You might think that Elon Musk made Bitcoin lose 40% of its value overnight, but that’s only true if you think in US dollar terms. Bitcoin didn’t change. US dollars changed. On a long enough time-frame, the relationship between US dollar and Bitcoin will reverse. You’ll think in terms of US dollar crashing or gaining value against Bitcoin. But those movements will be minuscule, because eventually Bitcoin will back the US dollar, and give it all its value.

In a world where countries don’t trust each other, the US dollar dominates international trade. It’s known as the world reserve currency. The value of the dollar is mostly based on US military dominance across the world. The strongest actor gets to make the rules. If you don’t believe me, go ask Gaddafi (although he’s very dead). There’s a reason why Russia and China don’t really use USD, but everyone else does. But the United States is faltering. It’s falling apart from the inside. Look at what’s happening in the world today. Do you really think that the US domination will continue for the next 10, 20, 50 years as it has for the last 50? New powers are rising, and not just China. European Union, for all its problems, was formed to act as a counterweight to US dominance in Europe. This new multipolar world will still need to trade with each other. But who can you trust? Bitcoin. It doesn’t discriminate and doesn’t care about your language, skin colour, military might or political views.

As Bitcoin becomes the de-facto method of international settlement, he who holds the most Bitcoin wins. There are only two ways to acquire Bitcoin: Mine it, or buy it on the open market. Of course you can always blackmail your citizens to hand over their private keys, but it doesn’t seem like the best PR move for your country. I predict there will be an arms race on the mining side and a mad rush on the buying side because the first-mover advantage is massive. If China goes all-in on Bitcoin, the US can’t really afford to stand on the sidelines, or vice versa. The geopolitical game theory of the situation forces both countries to act in each others interests. Just like the Bitcoin network itself, it will harvest both countries greed and turn it into peaceful trade. Attacking the network would only make you lose money. And a physical war is more expensive than an economic one.

By ushering in an era of forced international economic co-operation, Bitcoin will end all wars and commence the golden age of Pax Bitcoinica. When it comes to natural resources, offence is always cheaper than defence. But when it comes to encrypted decentralised digital assets, defence is infinitely cheaper than offence. If most of the value is held in abstract digitally encrypted assets, there are no incentives to stage a physical attack. And who can afford war in a world where you can’t print infinite money to finance it?

End of broadcast.