When the same people who blew up the world economy tell you it’s gonna be alright, you might want to be a bit suspicious.

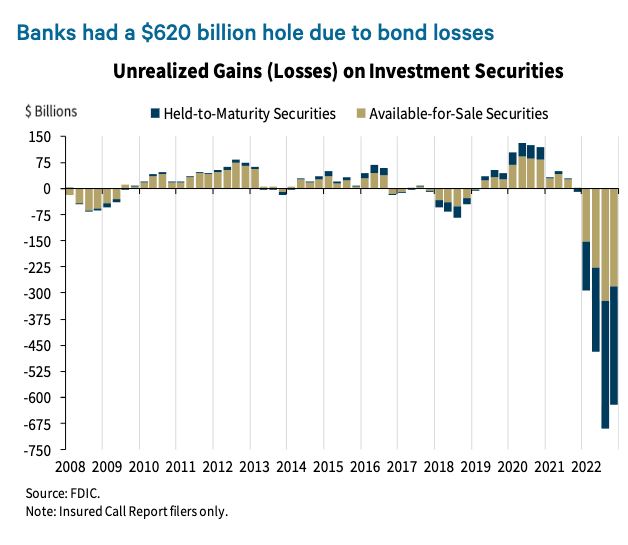

Two of the biggest three bank blow-ups in the US ever happened last week. Credit Suisse in Switzerland is, and has been, on the brink of collapse for awhile now. Contagion risks are everywhere. The Fed is injecting up to 4.4 trillion usd of liquidity into the banking sector via Bank Term Funding Program, by essentially guaranteeing every cent the banks hold. It’s a one-year program but as Milton Friedman said “Nothing is so permanent as a temporary government program”. And for reference, Fed printed roughly 4.189 trillion in response to COVID, the liquidity injection that started the whole craziness.

4.4 > 4.189 for the math-challenged.

The rate rises of the past year or so have resulted in inflation dropping from the highs of 9% down to 6% in the US. 6% is still a fuckload of inflation. For the rest of the world it looks even worse. And now the money spigots are turning on again, with full blast. There really are only two ways out of this situation:

- More rate rises, more pain, a lot more pain

- Quantitative easing or some other bullshit term for money printing, leading to hyperinflation which causes even more pain

It looks like the Fed chose door number two. The European Central Bank is still adorably raising rates but it’s not gonna take long for any number of European banks to fall under distress, in addition to the already mentioned Credit Suisse. And at that point, the only thing stopping a full-on monetary and banking collapse is more money printing by the ECB by stepping in to guarantee bank deposits. And if they don’t, all the smart money will run to the US faster than you can switch genders in any modern western country. If your money is personally guaranteed by the Fed to be safe when it’s held in dollars, and not in euros, well…

Why does any of this matter?

Well my son. Imagine a nice glass of Coca-Cola. Sugary, refreshing, bubbly, diabetesy, yummy. Now pour half a glass of water into it. What happens? Spill-over and dilution. This is what’s happening to the money in your pocket when the central banks fuck with it. They dilute your buying power and create spill-over effects that cause a mess. To clean that mess, they pour more water, further diluting your wealth. This is what they did when COVID hit. Then they started cleaning up the mess by taking the rest of your shitty watered down coke away. And now they’re turning on the garden hose on you again.

The worst part is that all of this was always fairly obvious. Most western countries are up to their necks in debt and there’s no realistic way to ever pay it back UNLESS you cause a massive inflationary melt-up. Essentially you blow up your own currency (and fuck over your populations) to pay your bills. And because people aren’t making more people like they used to, the clock is ticking. Now if only there was a term for a demonic plan like this. A very very very big reset?

Because I love saying that I told you so, here are some things to look out for in the coming months:

- Calls for central bank digital currencies to “fix” the situation with banks

- Blaming cryptocurrencies for the banking crisis (after all it all started with Silvergate, a “crypto-friendly” bank)

- Escalating tensions between great powers and more hot wars across the world, partly to distract and partly to justify money printing

We’re entering into an even messier world. Stay safe.